Read Transcript EXPAND

CHRISTIANE AMANPOUR: Now, for our next guest, who you might recognize from the hit T.V. show “Shark Tank” or as the owner of the NBA Dallas Mavericks. Mark Cuban’s business ventures have made him one of the world’s most recognized entrepreneurs, but it’s his passion for politics, which we’ve had some speculating about a potential presidential bid. He sat down with our Walter Isaacson just recently to talk about it.

WALTER ISAACSON, CONTRIBUTOR: So when you were a kid, they don’t know you’re going to be the world’s greatest businessman. Until your parents say hey, you have got to learn to lay carpet?

MARK CUBAN, OWNER, NBA DALLAS MAVERICKS: Yes. It was crazy because my mom was concerned about me and she wanted me to learn to trade. My dad had done upholstery on cars. And we were middle class, never struggled, right. But she said, you know, you’ve got to be able to take care of a family at some point. So she worked in a real estate office. And guy’s name was Bobby Freedman. He said, “We’re going teach you how to lay carpet.” So Bobby had an office on Washington Road in Pittsburgh. And I remember him just basically going in there saying, “Here is the carpet, here is the stuff. Right. And I’m going tell you what to do and let’s see how you do.” People are still tripping and falling in that office. It didn’t work out very well but —

ISAACSON: But one of the themes in your life is the things you fail out really starts helping you. So I’m glad you failed at laying carpet.

CUBAN: I am too. Right. I’m glad I failed rolling the bar. I’m glad I failed laying carpet.

ISAACSON: Tell me about some of your early business ventures like that when you were a kid and then a little bit older.

CUBAN: Oh my God, I remember my dad and his buddies used to play poker. And they would come to our house every few weeks and going to my dad and saying I want new pair of basketball shoes because I was a huge basketball junky then and now. And he was like see those tennis shoes you have? When you have your own job, you can buy whatever shoes you want.

ISAACSON: That’s an incentive to get a job.

CUBAN: Right? Well, so one of the guys who was at the poker table was like I can get a job for you. And I’m 12-years-old at the time. And I’m like what? And he goes I’ve got these boxes of garbage bags. Why don’t you go to the neighbors and sell these garbage bags? I’m like OK. You know, what should I sell them for? He goes “I’m going to sell them to you for three bucks.” There’s a hundred garbage bags and I never forget there were really little garbage bags but there was a hundred. And I bought them for $3 and sold them for $6. But here is how it went. Hi. My name is Mark. I live up the street. Walter, do you use garbage bags? Would you like to buy a hundred of them so you don’t have to worry about going to pick them up and I’ll bring them to your house every couple of weeks when you need them? And I was probably the world’s first garbage bags salesperson with a garbage bag route. And then from there, it just blossomed. I mean I was just always doing something, selling something. Because once I learned how to sell, everything was easy.

ISAACSON: When was the first time you got fired?

CUBAN: When I was working for Your Business Software. And I had gotten — I moved to Dallas with a bunch of my buddies. I was living with six guys in a three-bedroom apartment sleeping on the floor. Just, it was nasty. We used to call it the Hill Hotel. And I got a job working at night as a bartender and I got a job working at a software store. This is the early days of the PC industry. This is 1982, end of ’82, early ’83.

ISAACSON: Yes. Before the Macintosh.

CUBAN: Before the Macintosh, right. And this is when, when I worked there I had to go get certified in order to be able to sell lotus 1-2-3. That’s Spreadsheet for $495. But I recognized that I had an aptitude for tech and I loved it. And so I learned and learned and learned and start teaching myself to write Lotus 1- 2-3 macros and ToS scripts and debase programming. And finally, I got to the point where I had this big sale. It was going to be a $15,000 sale with a $1500 commission which meant I can move out of the Hill Hotel and get out of there. I mean literally, it was awful. And so some of my responsibilities were to come into the store, Your Business Software, and be there at 9:00 a.m., wipe down the windows, sweep the floor, open up a retail store effectively. And I called my boss, Michael, and I said, look, I’ve got it all set up. Someone’s going to cover for me. And I want to go close this deal, I’ll bring in the check. He goes no. I’m like what? I mean — so I made the executive decision. I was going to pick up the check thinking the store needed the business, right. Here is $15,000. When I came back, fired me.

ISAACSON: So what — that leads to some successes along the way.

CUBAN: Yes, big time. And so there I was with no job. So first thing I do was get my friend’s car and we all went down to Galveston from Dallas just to clear our heads. And I remember taking a pad, a yellow pad, and writing on it, OK, I’m going start my own consulting company if you will. Because PCs were new to everybody. And I just spent nine months every single day teaching myself to go working all night, learning this new stuff. And so I’m like OK, I’ve got to think of something that’s very succinct. So I came up with MicroSolutions. And I was going to go to businesses and anybody who, you know, because back then people didn’t realize they needed PCs. What do I need a PC for? I’ve got my secretary who has a typewriter and I’ve got a copy machine. This new PC thing, I don’t need it. And so I thought, OK, I’m going to take a chance. So I went to this company that had come into the store and didn’t buy anything, called Architectural Lighting. And they needed a time and billing program that was $500 retail and $250 cost. And I had no money. I mean literally back then we would go to the grocery store at midnight because that’s when they lowered the price of the chicken packs. And so, you know, I was broke. And so I went to them and I said, look, if you’ll front me the $500, if it doesn’t work for whatever reason, I’ll walk your dog, I’ll wash your car. Fortunately, it worked. And then from there I just added another referral, another referral, you know, kept on learning how to program. And for the next seven plus years, I coded and we built that company MicroSolutions to $36 million run rate sales and sold it to CompuServe.

ISAACSON: So how did you take the parlay, your winnings, from your first business? What did you start up next?

CUBAN: When I first got that money, I went to my friend, Charlie, and he was at Goldman Sachs and Roly Rolls was his partner. I want to invest like a 60-year-old man. I want it in — I want this to last me forever. If I have to live like a student forever. And then like, that’s not (inaudible) just do this for me, right. And then all the sudden they start to ask me questions about technology. They were like, what do you think about this company? What do you think about this software? What do you think is going it happen there? And they were trading on it and making a lot of money. Like OK, I’ll start trading. So I started making 80, 90, 100 percent a year on my money. Because back then, that’s — you know, they had one analyst, you know, Goldman who covered tech and, you know, one here and one there. And it was like taking candy from a baby. And so they wanted me to start a hedge fund, which I did for about three months. Then someone came in and bought it. And so right off the bat I’m like OK, I made a couple more million dollars. I made all this money from trading. But then come forward, fast forward to 1990 — early ’95, late 1994, I was back in Dallas and I was hanging out with one of my friends from college. And he was like you know what do you think about this idea of using the Internet, which is brand new, to listen to Indiana University basketball? I’m like OK, I’m a networking guy. I’m learning about the Internet. Let me see if I can figure it out. And so I bought a Packard Bell computer in the second bedroom of my house and I bought an ISDN line, which is a big deal back then, and a modem. Again, an ISDN modem. I’m like OK, let me see what I can do. I then went to the local radio station, KLIF in Dallas, an a.m. station and I said, look, this might be the new cable. This might be nothing. But I want to come down and record your radio shows and try to put them on this thing called the Internet. And let’s see what happens.

ISAACSON: So it’s streaming audio and it becomes broadcast.com.

CUBAN: Well, yes. Back then, it was called Internet broadcasting.

ISAACSON: Yes.

CUBAN: Then from there, it was like ready, set, go. So I took — I put up the initial money and we just started calling on every radio station we could find and just built that and then we turned it into broadcast.com once video became available. And then in 1998, we took it public. It was the biggest IPO in the history of the stock market at the time and then sold it to Yahoo! and the rest unfortunately is the wrong history.

ISAACSON: In order to be that innovative and to start all these tech businesses like that, it helped that you had space.

CUBAN: Yes.

ISAACSON: Nowadays, the big tech companies pretty much dominate. It seems harder to find the space to innovate. And yet you’re not in favor of breaking up or regulating the big tech company. Why?

CUBAN: First, I don’t think it’s more difficult. I think that the wedges are maybe harder to find, but the going to why not break up the tech cycle, talk about Facebook, right. You don’t need to use Facebook. This isn’t 1984 with AT&T where, you know, if you want to make a phone call, you have one way to do it and you had to go to AT&T. You want to share pictures with grandma? There’s a hundred ways to share pictures with grandma. You want to get a news feed? There’s a thousand ways to get a news feed. There’s not one feature on Facebook that isn’t replicated by 30 different products.

ISAACSON: Yes. But when a snap comes along and it competes with Facebook, Facebook can mush them down.

CUBAN: Yes, they can mush them down. When you run with the elephants, there’s the quick in the dead, right. And we used to have to compete with IBM and then you’ve always said that you’re competing with Microsoft. No matter what. Now, didn’t break — people discussed breaking up Microsoft and there was certainly anti-trust with I — Internet Explorer. I just —

ISAACSON: Yes, but there was anti-trust against Microsoft.

CUBAN: Sure.

ISAACSON: There’s anti-trust against IBM.

CUBAN: Sure.

ISAACSON: And this opens the way for things for be it Netscape or Apple to come along. Don’t you think we need a little bit more anti-trust enforcement?

CUBAN: Well, there’s two different things. One, in terms of acquisitions. OK, there’s a good argument to be made that there should be — there are certain spaces maybe that we shouldn’t allow acquisitions.

ISAACSON: You know there’s Facebook taking Instagram.

CUBAN: Right, of course. But no one thought Instagram was a huge deal when they bought Instagram. It was still growing. Remember Instagram started in 2011. Remember, as Snapchat had a chance to sell to them and they didn’t. I remember sitting, talking with Evan Spiegel and saying, look, dude —

ISAACSON: Yes. But wouldn’t it have been bad if Facebook just gets to buy up everything?

CUBAN: Again, what are they actually buying? It’s one thing if it were something that is a utility that you have to use. It’s another thing if it’s all optional. I mean, look at what happened — look at what is happening to Facebook in the United States. Their audience is declining. My 13 and my 16-year-old kids have no interest in Facebook whatsoever. My 81-year-old mom does, right. My wife uses it to keep up with her parents and some of her friends. But there’s no real utility to it. And even now when you look at our companies that are buying advertising, it’s more effective now on Google than it is on Facebook. Unless you’re selling to an older audience.

ISAACSON: OK. But put on your shark tank hat. Every Sunday night, right. People come and they pitch a business to you. Don’t you think pretty early on in the pitch how could Facebook or how could Google crush this thing before you invest?

CUBAN: Always. Always. But it’s always been that way but it doesn’t mean there can’t be great ideas. You know, yes, IBM have survived in some manner. Microsoft took cloud computing really to reinvigorate them but Facebook, I don’t see that there’s an eternal right for Facebook to exist or for Google.

ISAACSON: Do you think businesses should have a double bottom line, that they should be —

CUBAN: Yes, without question. So — and you look at it — I don’t look it as a double bottom line. I look at it as the big picture, right. I think you’ve got to be socially aware. Because the one thing that destroys a business is social unrest. If you’re in a community that can’t be rebuilt, you know, or is having social problems or there’s violence, you’re not doing business, right. If you’re in an industry that is contributing to — pick a topic whether it’s climate change, whether it’s discord, right, people are paying attention now. The flip side of the Internet and social media is just so easy to send a message on what you care about. Now from a business perspective, if you’re able to contribute in more than just your own personal bottom line, people recognize that change is happening in this world and maybe there’s a better reason to do business with you. You know, even if you’re — what you’re selling costs a nickel more, you’re contributing more than a nickel’s worth of value to the world that my kids have to live in or that I, as an 18-year-old, will have to live in in 20 years. So I think it’s not just good for the bottom line but it’s good for sales.

ISAACSON: How would you apply your entrepreneurial skills and business skills to some of the nation’s problems like health care?

CUBAN: Right. I’m glad you asked. So health care has gone from Obamacare really trying to change the game to now the discussion of Medicare for All/Single payer. Obamacare made a structural mistake when they built the whole program on insurance. The problem when you build a program with insurance, the incentives of the insurance companies are not aligned with health care or wellness. Now, you look to single payer and they’re saying, well, insurance companies are part of the problem. So OK, let’s remove them but they don’t deal with equity issues at all. You know, there’s no reason for somebody who’s making $50,000 — a family who’s making $50,000 a year to pay more taxes to pay for my family’s health care. You know it’s just wrong. And so I think rather than addressing how to pay for it as a model, which is what’s happened up to this point, we have to look at what makes people healthier. Politically, you can make things work like you can have a hybrid where somebody who is making up to 400 percent of the poverty level, they have single payer, right. Maybe there’s a small copay. Maybe there’s not. But effectively, their health care — insurance to their health care is free. Somebody who is making over — maybe their health care is based off a percentage of their income that is means tested. So if you make $80,000 a year as a family, you might pay two percent. If you make a $100,000, you might pay six percent. But that has equity to it. So that we’re not all trying to have one size fits all because it won’t work. So you have to look at this not as a model, how are we going to pay for things, we just raise taxes, which I’m not opposed to, but let’s just pay for everybody’s health care. But we have to start asking the question, how are we going to make people healthier? Because If we make them healthier, then our cost for health care go down.

ISAACSON: What do you think about wealth tax?

CUBAN: It depends on the details, right. Look, fundamentally, I’m not opposed to paying more taxes at all. A wealth tax, or national property tax if you want, it really depends on what type of assets you attach it to. are they liquid? Will they cause some other harm? It really depends on the details. It sounds really good right now but I think the bigger fundamental problem from some of the further left candidates is we know we’re going to raise taxes, right. And that’s fine. And we know they’re going to raise taxes the maximum amount they can. And that’s fine too. But we don’t work backwards from the amount of money we’re going to raise and prioritize what needs to happen next. When you listen to candidates right now, you don’t see prioritized lists. It’s not like they’re saying well, this is number one, this is number two. And then when we get down the bottom here, because that’s not how politics works. But someone needs to come in and say what are your priorities? And that’s just not happening.

ISAACSON: What would you do about gun control?

CUBAN: That’s a great question. And I know I’m going to get a lot of hell. I think you can own anything you want. I don’t care what it is if it’s a bazooka, as long as it’s in your house and on your property. And the minute you take it off your property, go right to jail. Unless you alerted the appropriate authorities and we put a GPS on that device. So if you want to go to the gun club, hey, guys, I’m going, I called the local police and they’re following me, right. If you have to carry the resents and you get a carry license, hey guys, I’ve got my GPS on my gun, I’m taking the bank receipts — I’m taking the receipts to the bank. If you can track me on your Google Maps, you know exactly where I am. But, to me, you have the right. I mean it’s just who we are as —

ISAACSON: But wait, don’t you worry about the privacy rights of the government using a GPS to track your weapons?

CUBAN: Not for specialty issues because we — insurance — we’re tracked all the time no matter what. In New York City, if you break the law, there’s going to be a camera that caught you somewhere, right. And with computer vision, they’re going to know it’s you. So do I freak out about that? No. I’m a Scout McNealy fan who says you have no privacy, just get used to it. And so from a gun control perspective, protect your property. If that’s what you think is the best way to protect your family, go for it. This is the United States of America. I’m not a gun advocate in a big way. I’m not a gun fan, right. But at the same time we are who we are.

ISAACSON: So why aren’t you running for president?

CUBAN: Because my family voted it down.

ISAACSON: Come on. Come on. Come on.

CUBAN: Seriously.

ISAACSON: All right. But, I mean, don’t you think you should be getting into public life if you have these passions?

CUBAN: There’s different ways to do it. There’s different ways to impact health care. So literally, a lot of things that we discuss on the periphery, I put into a package called the temp plan that I literally had had scored by three different economic groups. Right now the rand is scoring it on 10-year plan just like the office and budget management would do. I’ve taken it to the Democrats. I’ve taken it to the Republicans. When all the Medicare for All stuff hit, the Democrats kind of pushed it down but the Republicans are incorporating it to a lot of things that they’re potentially talking about. And so I met with a lot more Republicans lately. But that’s one way. If I can push that forward and the numbers continue to prove it out, because effectively I think everybody deserves the right to be healthy but we have to get you there, right. And it can’t just be, like I said, just worrying about how you pay for it. It’s how do we get you healthy. So that’s one. You’ll see me do some other things in health care when it comes to drugs that I really can’t go into detail yet. But even though I may not be running, you don’t have to be the leader to be a leader.

ISAACSON: Thank you, Mark.

CUBAN: Thank you, Walter. I really enjoy it, as always.

AMANPOUR: We’ll look for those proposals. That’s it for us tonight. Thanks for watching and good night from London.

END

About This Episode EXPAND

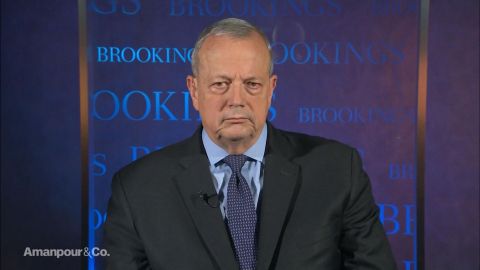

Gülnur Aybet discusses the situation between Turkey and the Syrian Kurds with Christiane Amanpour, then John Allen gives his perspective on the subject. Writer and director Chris Morris joins the program to discuss the new film “The Day Shall Come.” Mark Cuban sits down with Walter Isaacson and reflects on his career as an entrepreneur.

LEARN MORE