Read Transcript EXPAND

CHRISTIANE AMANPOUR, HOST: Turning to the world of cryptocurrency, following the collapse of an industry giant. FTX, the world’s second largest exchange of that regard, is sending shockwaves throughout the industry ever since it filed for bankruptcy on Friday. Axios chief financial correspondent Felix Salmon joins Hari Sreenivasan to explain the consequences of this meltdown.

(BEGIN VIDEO CLIP)

HARI SREENIVASAN, CORRESPONDENT: Christiane, thanks. Felix Salmon, thanks much for joining us. First, let’s break this down a little bit. What is FTX? Who uses this?

FELIX SALMON, CHIEF FINANCIAL CORRESPONDENT, AXIOS: It’s an exchange. It’s where you go to trade cryptocurrency. If you wanted to trade in and out of Bitcoin, Ethos, Solana even stable coins, you would need to do that on some kind of an exchange. And FTX was, up until last week, the second biggest crypto change in the world. So, traders and especially sophisticated traders, were drawn to FTX. The ones who would trade very frequently, in high volumes, often for clients.

SREENIVASAN: OK. So, last week, what happened? What was revealed by this Trade Publication CoinDesk?

SALMON: Well, it turned out that all of the money that people put on to FTX with the intention of trading it — well, not all of it, but probably a majority of it, had actually been transferred out of the exchange entirely and to this sister hedge fund of FTX, called Alameda Research, which had a big hole in its balance sheet. And it just disappeared. So, when people wanted to get their money back, it wasn’t there.

SREENIVASAN: So, walk us through kind of what happened last week. Because there was this moment where, after these revelations, that some of the funds were missing and there’s kind of a run on the bank, so to speak, then there was the opposition, so to speak, of competing exchange was about to buy FTX and kind of save it.

SALMON: So, the biggest exchange in the world, Binance, is — has this kind of long-standing friction with FTX. They don’t like each other very much, even though Binance was an early investor in FTX. And a week and a half ago, something like that, CoinDesk is this publication, came out and revealed that the Alameda Research balance sheet was looking a little bit dodgy in various ways. It had a lot of its — the FTX exchange token, it’s a bit nerdy, but basically, it raised questions about the quality of the balance sheet and just how much money FTX and Alameda Research had. Because he was an early investor in FTX, the CEO of Binance, this guy, CZ, decided he was going to sell all of the token that he owned. And that was a precipitating event that caused the bank run that caused the death of FTX.

SREENIVASAN: And so, after that, why did Binance choose not to rescue it?

SALMON: So, in the first instance, he said, well, what we need to do is rescue the assets first. Even if we lose half a billion to a billion dollars rescuing FTX and filling the hole on its balance sheet, it’s worth it to us just so that broad faith in crypto generally isn’t hurt. If everyone in FTX gets their money back, that’s great for everyone, including us. And if we have to pay a little bit of money to ensure that, we will. He then starts looking at FTX and discovers, number one, that the hole is much bigger than you thought it was. And number two, that it’s under criminal investigation by U.S. authorities. And at that point, he’s like, I can’t touch this anymore, and he walked away.

SREENIVASAN: So, let’s talk about those other three initials that are getting a lot of headlines, SPF, that’s Sam Bankman-Fried, the founder, I’ve heard him in lots and lots of interviews say, you know, kind of — when asked like, what’s the big difference in what are you doing? He would always say, managing risk. And, you know — and he was literally a guy that was out in front of regulators asking them to regulate this industry. So, that seems pretty ironic at best.

SALMON: He came from a very famous hedge fund here in New York called James Street, as did the CEO of Alameda, Caroline Ellison. And Jane Street is legendary for exactly this thing, of managing risk and making sure that you never lose too much. It just seems that at some point fell by the wayside. And he started advancing a much greater appetite for risk than people thought he had. People knew he had a strong appetite for risk, but nothing like this. And he was just making these kinds of bets on salvation, where he but the entire company trying to make his losses back.

SREENIVASAN: He also became a bit of a poster boy for this industry because so many people, for so long, had talked about how cryptocurrencies are the wild west, and he was trying to change that image and his success seems to be doing so.

SALMON: He spent a huge amount of time on Capitol Hill, trying to persuade American lawmakers to create regulatory regimes, I would say, that would let him operate his exchange in the United States. But the fact that he jurisdiction shopped around the world and wound up in the Bahamas, which had basically the friendliest crypto jurisdiction you could find, is a sign that he wasn’t really looking for tough regulation. He was looking for a regulator that would let him do whatever he wanted to do.

SREENIVASAN: How rich did he become, at least on paper?

SALMON: $26 billion.

SREENIVASAN: And how rich do you think he is today?

SALMON: Probably negative. I mean, depending on how much he personally guaranteed. It’s a bit hard to tell, he will probably have some money left over. But yes, definitely, he is no longer a billionaire anymore.

SREENIVASAN: What is it that made Sam so trustworthy or credible? Why was he, you know, called the next Warren Buffett or all kind of — you know, just saying, OK, this is the guy who’s going to be able to regulate the unregulated and create — you know, make sense out of this wild west?

SALMON: It’s a very good question. I mean, he didn’t look on the face of things to be particularly credible, he was thie (INAUDIBLE) schlubby (ph) guy who only ever wore shorts and a t-shirt, who is based in the Bahamas, who had hedge funds. None of these things scream trustworthiness, right? But in the world of crypto, he was probably the most credible person they had. And the people in the crypto world had so much money invested in crypto becoming this incredible technology that they basically just poured all of their hopes and dreams onto the shoulders of this 30-year-old kid. And it — yes, turned — turns out to have been a pretty bad idea.

SREENIVASAN: We should note that he has not yet been charged with any crimes, right? I mean, this is — right now, he’s acknowledged in some tweets that he’s made mistakes but nothing has crossed over into illegality, yet.

SALMON: The internet is concerned. You know, the internet is not (INAUDIBLE) judges. The internet seems to be pretty convinced that he engaged in criminal activity. You’re absolutely right, he has not been charged with any crime by any authorities. And you know how long it takes to draw up an indictment.

SREENIVASAN: Yes.

SALMON: So, that could be a while, if it does happen, it could be a while before it happens.

SREENIVASAN: So, we are talking about the actions of one exchange, one person. What is the ripple effect that this will have on the crypto industry? I mean, you wrote this week that this was the week that the crypto dream died. Explain that.

SALMON: The crypto dream was this dream that SBF was selling to his venture capital backers. The crypto dream was this idea that really started in 2010 after the financial crisis, that dollars and pounds and yen are untrustworthy because they are issued by governments and you can’t trust governments. And the banking industry is not trustworthy, it caused this massive global financial crisis in 2008. And what we need to do is replace all of that, what is known as fiat currency, government issued currency, with something that you don’t need to trust, something that you — all you need to do is trust mathematics, and that’s it. And then, it’s — you know, it’s just mathematically preordained, basically. And you would eventually wind up using these cryptocurrencies, in Sam Bankman-Fried’s words, to buy a banana. You know, it would become how you were paid, how you transacted, how the world — the payment rails to the entire world would become crypto rather than fiat. That was the dream. We didn’t get very far towards the dream. Truth be told. But the dream was still alive. The crypto true believers still believe in that dream up until last week. And I think at this point, they no longer believe in that dream because it is obvious how useful governments really are in a payment system. It’s obvious how important it is that you have the lender of last resort and some kind of government who can bail out a financial industry if they need to.

SREENIVASAN: So, what happens now to all those people who did lose that money? Now, I should say, I mean, the way that you are characterizing it and the kind of traitors that are using this are probably the more sophisticated kind, probably the kind of people who should know the risks of doing business on this platform, right?

SALMON: So, whenever you have any kind of financial crisis, it’s always the stuff you trust that is the most dangerous. If you invest in something like Bitcoin, which goes up and down by thousands of dollars a day and no one has any predictability around it, then you expect that the value of your Bitcoin will go up a lot or down a lot and you know that if it goes down a lot you can lose that investment, and that’s fine. You are walking into that risk with your eyes wide open. But if you put one Bitcoin on the FTX exchange, you have lots of faith and trust thanks to blockchain technology and distributed ledgers, and you can see where that Bitcoin is, in theory, that that Bitcoin is always going to be worth one Bitcoin. And no matter how much Bitcoin is worth you can always get that Bitcoin back. And that is something that you felt was a pretty safe bet. And so, there is where you feel very betrayed right now because you put a Bitcoin into the exchange and you don’t get back one Bitcoin, which is worth less. You can get back zero Bitcoins, and that’s really — if you can’t trust FTX and you can’t even trust some of that distributed financial exchanges that FTX was running, then that really does make crypto just a — you’re taking a lot more risk and what you own is unhedgeable (ph) risk.

SREENIVASAN: Yes. So, what do you think this does to the regulatory environment? Do you think members of Congress or anywhere in the world are going to look at this and say, look, we really need to get our handle on this?

SALMON: Oh, they have been saying that for years and they will continue to say that for years. And there are two big problems. Number — the first big problem is that the American lawmakers can’t really agree on how they want to regulate it. The regulators, the CFTC, the SEC, the OCC, all those kinds of people, are all absolutely unanimous that they need Congress to make some laws, you know, saying what the regulations are. They punted it over the Congress and Congress can’t agree on anything right now. So, it’s going to be very hard to get Congress to really put together a robust set of regulations, and it will take many years if it ever happens at all. And then, the second problem is, that even if the U.S. Congress did do that, as what we’ve seen, crypto is global. It’s international, is based in places like Singapore, in Hong Kong, in the Bahamas, and it’s not clear that a set of robust and coherent American regulate nations would prevent someone from going to the Bahamas and doing exactly what we just saw.

SREENIVASAN: What do you see in the weeks going forward on the ripple effects of this? There been previous kind of, not just mishaps, but mishandling of funds and other problems that have happened with exchanges. Is this a bigger deal?

SALMON: This is the biggest one since 2014 when Mt. Gox, which was the biggest exchange at the time like just disappeared overnight. As they say, like the value of coins, yes, that can go down, that could go up. People know that risk, they take that risk, they are used that risk. If the value of coins goes down by another 25 percent after already having gone down by, you know, 70 percent, fine, whatever, like the crypto world can totally cope with the value of coins going down. The — what it finds — what it’s going to find much harder to recover from is this general feeling of there is no and we can trust. And even though what we wanted to do was create a trust-less system where you didn’t need to trust anyone, in practice, you always need to trust someone.

SREENIVASAN: Over the past couple of years, we also saw, otherwise, kind of traditional financial institutions opening up their exposures to cryptocurrency partly because people were seeing these Super Bowl ads, they wanted to get it on this market that just went up, up and up. So, is there an impact on traditional financial markets, any kind of more retail investor that might be going through their trusted bank to say, you know what, let’s put, I don’t know, 10 percent in this crazy crypto space?

SALMON: So, yes. If you have a Robinhood account or a Square Cash app account and you have crypto in that account, then it’s almost certain that that crypto is worth less than it was a few months ago. And that was true even before the FTX blowup, part of the reason why FTX blew up was because everything in the crypto world had declined a lot in value and that we surmised caught some of the problems with the Alameda balance sheet on. So, that’s the bad news. The good news is that the overwhelming majority of those people, if you had your crypto coins somewhere like Robinhood or Coinbase or even, as you say, a big institution like Goldman Sachs or JPMorgan, they’ve kept onto those coins. You still have those coins, you have access to those coins, no one has stolen those coins, they might not be worth as much as they wear when you bought them but they are still there. And in general, U.S. regulated institutions seem to have weathered this storm and none of them, with the exception of FTX U.S., seemed to have had any problems. But FTX U.S. is a problem, right? FTX U.S. continued to operate even after FTX failed. And everyone said, well, look, FTX U.S. is firewalled, is ringfenced, you can continue to withdraw, don’t worry about it. And then, one day, it filed for bankruptcy and ended all withdrawals. So, that’s a big problem for the people who think that American institutions are safe because there’s relatively small American institution, it’s still American institution, and that one turned out to not be trustworthy either.

SREENIVASAN: Felix Salmon, chief financial correspondent for Axios, thanks so much for joining us.

SALMON: Thank you.

About This Episode EXPAND

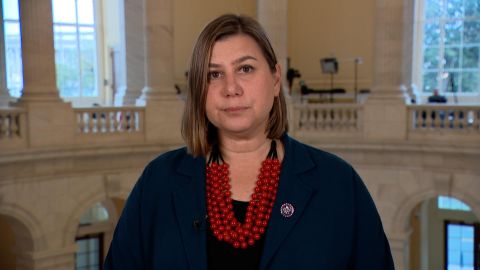

Rep. Elissa Slotkin reflects on the midterm elections following her win. Iranian actress Zar Amir Ebrahimi discusses her new film “Holy Spider.” Finance journalist Felix Salmon explains why cryptocurrency exchange FTX went bankrupt and what that means for the crypto sphere.

LEARN MORE